Initial public offering

On July 16, 2008, Adaro Energy Indonesia (AEI) was officially listed on Indonesian Stock Exchange (IDX) with ticker code ADRO after completing the IPO process for 11,139,331,000 shares or 35% of the 31,985,962,000 shares issued and fully paid-up. By raising Rp12.2 trillion, this IPO is one of the largest IPOs in the IDX history. The net proceeds from the IPO were entirely spent as of May 29, 2009 and were reported to its shareholders during the AGMS on June 3, 2009.

Indonesian stock market in 2022

At the beginning of January 2022, the Jakarta Composite Index (JCI) opened at 6,665 and continued to increase as the stock market was heavily and positively driven by the economic recovery, reaching its highest at 7318. The data of Indonesia Stock Exchange (IDX) shows that up until the end of December 2022, the buying of foreign investors’ stock transactions totaled $1,212 billion, with the net purchase of $60 billion. At the end of 2022, the JCI closed at 6,850, or 4% higher than 6,581 at the end of 2021.

ADRO in 2022

At the beginning of 2022, ADRO opened at Rp2,370, and reached its lowest at Rp2,160. Along with the rising coal price, ADRO gradually increased until its highest level of Rp4,140 in 2022. ADRO closed at Rp3,850at the end of 2022, marking 71% higher than the closing price of Rp2,250 at the end of 2021.

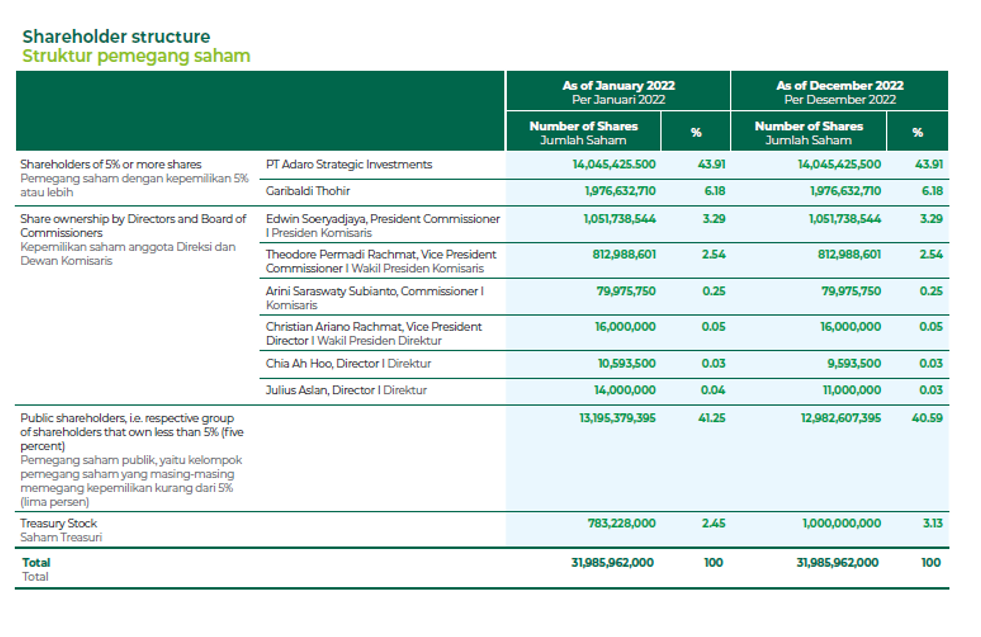

ADRO's market capitalization at the end of 2022 stood at $7,9 billion, or 61% increase from $5 billion at the end of 2021. Average daily trading value for ADRO in 2022 was $25 million. At the end of 2022, the total public shareholders constituted 33.146% out of AEI’s total shares, consisting of 80% domestic holders and 20% foreign holders. ADRO shareholders were dominated by institutional investors, consisting of 26.67% local institutions and 59.05% foreign institutions.

Dealings in the company’s shares

In 2022, AEI’s BoD members, Chia Ah Hoo and Julius Aslan, sold one million shares and three million shares respectively, out of their own ownership. As a result, at the end of 2022, Chia Ah Hoo owned 9,593,500 shares, while Julius Aslan owned 11,000,000 shares of ADRO. These transactions had been reported to the regulators to comply with the applicable rules and regulations.

Dividend payment

Based on the company’s Article of Association, dividends are distributed in accordance with the company's financial capability based on the decisions taken at the Annual General Meeting of Shareholders (AGMS). The company will declare dividends with respect to: 1) The operating income, cash flow, capital adequacy and the financial condition of the company and its subsidiaries with regard to reaching optimum growth in the future; 2) The required fulfillment of reserve funds; 3) The company and its subsidiaries’ obligations based on agreements with third parties (including creditors); 4) Compliance with prevailing laws and regulations, as well as the AGMS approval.

The 2022 AGMS approved a total dividend payment of $650 million, equivalent to 70% of the 2021 profit attributable to owners of parent entity of $933 million. The Interim Dividend of $500 million for the fiscal year 2022 was paid on January 13, 2023. The distribution of this interim dividend will be reported to the AGMS in 2023.